If you’re living in the United States, you probably take lawsuits seriously. You may know how devastating they can be and how frequently they actually happen, even in San Antonio. We’re in the midst of a lawsuit craze, and that means that just about anyone is at risk.

If you do get sued, you will have to pay for it no matter what – even if it’s just the fees to the attorney you hire to defend your case. And that’s just if you manage to win the case. If you lose or settle, you will also have to pay the person who is doing the suing. So what should you do? Even if you currently have insurance of some sort, you may want to consider investing in umbrella insurance.

Coverage

When thinking about how much you are covered for, how much do you estimate is going to be enough in the case of a lawsuit? If you are in a car accident and you are the one at fault, you are clearly the person who is going to have to pay. In case the worst happens and you are in a car accident, for instance, your current coverage might only be up to about $100,000.

If it’s an accident where the suing party is injured enough to not be able to work for a long period of time, (not to mention their medical expenses and other aspects they might sue you for), do you really think $100,000 from your auto liability insurance is going to cover it all? Let’s not even get started on the expenses going to your lawyer. To be totally safe from being ruined from a situation like this, you are going to need more coverage.

Umbrella Insurance

The solution for you might be umbrella insurance. It’s not terribly expensive, and it works for a variety of situations. Not only does it cover physical injuries, it also covers “personal injuries,” or damage done to a person’s reputation or career, or things like invasion of privacy, false imprisonment, and so on.

That being said, umbrella insurance won’t cover everything. Punitive damages, for instance, are not included in the package. Umbrella insurance basically just pays for the remainder of a bill. Let’s take the car accident example again. If you end up needing to pay $300,000, your car liability insurance will likely cover the first $100,000, and the umbrella insurance will take care of the rest – with a deductible of up to a few thousand dollars, of course.

For many people needing legal services, paying the extra money for umbrella insurance is a safer bet than sticking with auto insurance or homeowners insurance. Speak with an insurance agent about this type of coverage.

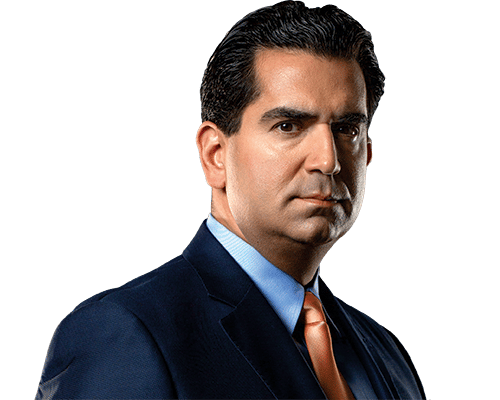

If you are, however, searching for San Antonio car accident lawyers to help you win a lawsuit, or defend you from one, call us. Even if you don’t have umbrella insurance, we can review your situation and let you know how we can help.

The Villarreal & Begum, LAW GUNS dedicates their time and effort towards helping people in Texas find justice for personal negligence encountered while living their normal, everyday lives.